The cost of wind, the price of wind, the value of wind

Posted by Jerome Guillet in Explanation, Wind energy 2 Comments» I’d like to try to clear some of the confusion that surrounds the economics of wind power, as it is often fed and used by the opponents of wind to dismiss it. As I noted recently, even the basic economics of energy markets are often willfully misunderstood by commentators, so it’s worth going in more detail through concepts like levelised cost and marginal cost, and identify how different electricity producers have different impacts on electricity (market) prices (which may or may not be reflected in retail prices) and have different externalities. Value for society of a generation source may also include other items that are harder to account in purely monetary terms (and/or whose very value may be disputed), such as the long term risk of depletion of the fuel, or energy security issues, such as dependency on unstable and/or unfriendly foreign countries or vulnerable infrastructure.

I’d like to try to clear some of the confusion that surrounds the economics of wind power, as it is often fed and used by the opponents of wind to dismiss it. As I noted recently, even the basic economics of energy markets are often willfully misunderstood by commentators, so it’s worth going in more detail through concepts like levelised cost and marginal cost, and identify how different electricity producers have different impacts on electricity (market) prices (which may or may not be reflected in retail prices) and have different externalities. Value for society of a generation source may also include other items that are harder to account in purely monetary terms (and/or whose very value may be disputed), such as the long term risk of depletion of the fuel, or energy security issues, such as dependency on unstable and/or unfriendly foreign countries or vulnerable infrastructure.

Depending on which concept you favor, your preferred energy policies will be rather different. Follow me below the fold for a tour.

The usual disclosure: my job is to finance, among other energy projects, wind farms. My earlier articles on wind power can all be found here

Costs

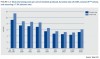

The cost of wind is, simply enough, what you actually need to spend to generate the electricity. The graph below shows how these costs have changed over the past decade: a long, slow decline as technology improved, followed, over the past 3 years, by an increase as the cost of commodities (in the case of wind, mainly steel) increased, and as strong demand for turbines allowed the manufacturers (or their subcontractors) to push up their prices:

Source: Economics of wind (pdf) by the European Wind Energy Association

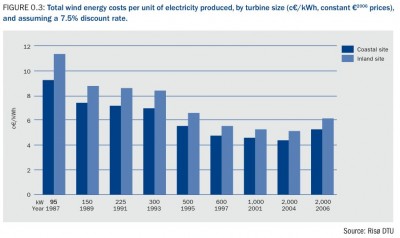

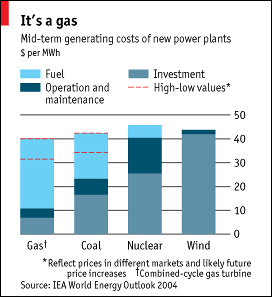

The most recent Energy Outlook by the International Energy Agency suggests that wind power currently costs €60/$80 per MWh, which makes it, today, pretty close to what the traditional generation sources (nuclear, coal, gas) cost:

Source: World Energy Outlook 2008 (available on order only)

In the case of wind, it is important to note that most of the costs are upfront, i.e. you need to spend money to manufacture and then install the wind turbines (and build the transmission line to connect to the grid, if necessary), but once this is done, there are very few other actual costs: some maintenance and some spare parts now and then.

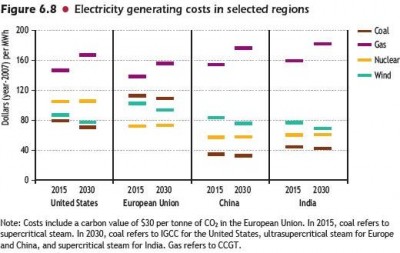

This means that the levelised cost of wind (i.e., the average cost over the long run, when initial investment costs are spread out over the useful life of the wind turbines) is going to be highly dependent on the discount rate, i.e. the hypotheses used to spread the initial cost of investment over each MWh of production over the useful life of the wind turbine, both in terms of duration, and the rate used. The graph below shows the sensitivity of the cost of wind depending on the discount rate used (over 20 years):

Source: Economics of wind (pdf) by the European Wind Energy Association

The discount rate is the cost of capital applied to the project, it will depend on whether you can find debt (whose price can depend on your credit rating) or need to provide equity (which is usually more expensive); altogether this means that most of the revenue generated by a wind farm at any point during its lifespan will go to repay the initial investment rather than to actual short term production costs; moving the discount rate from 5% to 10% increases levelised costs by approximately 40% (whereas for a gas project, it would typically be less than 20%).

Source: the Economist, 2005 (Note: this reflects price for gas at 3-4$/MBTU)

As a consequence, the marginal cost of wind is essentially zero, i.e., at a given point in time, it costs you nothing to produce an extra MWh (all you need is more wind). In contrast, the marginal cost of a gas-fired plant is going to be significant, as each new kWh requires some fuel input: that marginal cost is very closely related to the price of the supply of the volume of gas needed to produce that additional MWh.

The cost structure of wind and gas-fired power plants are completely different, as the graph to the right (from the Economist) shows: one includes mostly finance costs, the other mostly fuel costs (with nuclear closer to the economics of wind, and coal closer to the economics of gas).

It is worth emphasizing that “letting the markets decide” is NOT a technology-neutral choice when it comes to investment in power generation: public funding (such as can be available to State-owned or municipal utilities) is cheaper than commercial fund of investment: given that different technologies have different sensitivities to the discount rate, preferring “market” solutions will inevitably favor fuel-burning technologies, whereas public investment would tilt more towards capital-intensive technologies like wind and nuclear.

This also means that, once the investment is made, the cost of wind is essentially fixed, while that of gas-fired electricity is going to be very variable, depending on the cost of the fuel. The good news for wind is that its cost is extremely predictable; the bad news is that it’s not flexible at all, and cannot adjust to electricity price variations.

Or, more precisely, wind producers take the risk that prices may be lower than their fixed cost at any given time. Given that, as a zero-marginal cost producer, the marginal cash flow is always better when producing than not, wind is fundamentally a “price-taker,” i.e., the decision to produce will not depend on the price; however, the ability to repay the initial debt will depend on the level of the price, and if prices are too low for too long, the wind farm may go bankrupt. Meanwhile, gas producers take a risk, at any time, on the relative position, of the prices of gas and of electricity (what the industry calls the “spark spread“). This is a short term risk: gas-fired plants have the technical ability to choose to not produce (subject to relatively minor technical constraints) at any given time, they can thus avoid any cash flow losses, and the very fact that they shut down will influence both the gas price (by lowering demand) and the electricity price (by reducing supply). In fact, as we’ll see in a minute, electricity prices are directly driven, most of the time, by gas prices, and thus gas-fired plants are “price-makers” and thus their costs are what drive electricity prices.

This suggests, once again, that selecting market mechanisms to set electricity prices (rather than regulating them) is, again, not technology neutral: here as well, deregulated markets are structurally more favorable to fossil fuel-based generation sources than publicly regulated price environments.

At this point, the conclusions on the cost of wind power (ignoring externalities, including network issues, which I discuss below) are that they don’t seem to be that different from those of traditional power sources (nukes, gas, coal), but that they have a very different relationship to prices. So let’s talk about prices.

Prices

There are two aspects here: the price received by wind producers, and the price paid by buyers, which may be different.

The price of wind energy is what wind energy producers get for their production. It may, or may not, be related to the cost of the generation, but you’d expect the price to be higher than the cost, otherwise investment would not happen. But the question is, of course, whether the price needs to be higher all the time, or just on average, and if so, for what duration.

Given, as we’ve seen before, that wind has fixed prices, all a wind producer requires is a price which is slightly above what its long term costs are. That makes investment in wind profitable and actually rather safe (which means that a fairly low return on capital is required). The problem, as we’ve seen, is that wind is a price-taker and, unless producers are able to find long term power purchase agreements (PPAs) with electricity consumers at such prices, it is subject to the vagaries of market prices. And when your main burden is to repay your debt, and you don’t have enough cash for too long (because prices are below your cost for that period), you go under right away, even though you can generate a lot of cash (remember that wind is a zero-marginal cost producer and can generate income whatever the market price is) – which means that a bankrupt wind farm will always be a good business to take over; it’s just that it may not be a good business to invest in if prices are too volatile…

And thus it is not that surprising that the most effective system to support the development of wind power has been so called feed-in tariffs whereby the wind producers get a guaranteed, fixed price over a long duration (typically 15 to 20 years) at a level set high enough to cover costs. The fixed price is paid by the utility that’s responsible for electricity distribution in the region where the wind farm is located, and it is allowed by the regulator to pass on the cost of that tariff (i.e. the difference between the fixed rate and the wholesale market price) to rate payers. It’s simple to design, it’s effective and, as we’ll see, it’s actually also the cheapest way to promote wind. Other mechanisms include quotas which can be traded (that’s what green certificates or renewable portfolio standards amount to) or direct subsidies, usually via tax mechanisms. Apart from tax benefits, which are borne by taxpayers, all other schemes impose a cost surcharge on electricity consumers (although, as we’ll see below, in the case of feed-in tariffs, that surcharge may not exist in reality, as we’ll see below).

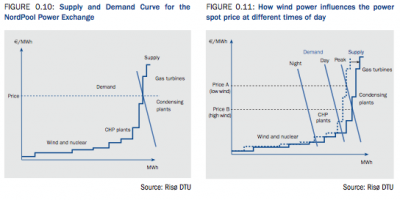

But there’s an even trickier aspect to wind and electricity prices: in market environments, marginal cost rules, i.e. the price for electricity is determined, most of the time, by the most expensive producers needed at that time to fulfill demand. Demand is, apart from some industrial use, not price sensitive in the very short term, and is almost fixed (people switching lights and A/C on, etc…), so supply has to adapt, and the price of the last producers that needs to be switched on will determine the price for everybody else.

Source: Economics of wind (pdf) by the European Wind Energy Association

If you look at the above graph, you see a typical ‘dispatch curve’, i.e. the line representing generation capacity, ranked by price. Hydro is usually the cheapest (on the left), followed by nuclear and/or coal, and then you have gas-fired plants and CHP (combined heat and power) plants, followed to the far right by peaker plants, usually gas- or oil-fired.

You take you demand curve (the quasi vertical lines you can see on the right graph), and the intersection of the two gives you the price. As is logical, night time demand is lower and requires a lower price than normal daytime prices, and even less than peak demand which requires expensive power generators to be switched on.

The right hand graph shows what happens when wind comes into the picture: as a very low marginal price generator, it is added to the dispatch curve on the left, and pushes out all other generators, to the extent is available at that time. By injecting “cheap” power into the system, it lowers prices. The impact on prices is pretty low at night, but can become significant during the day, and very high at peak times (subject, once again, to actual availability of wind at that time).

Source: Economics of wind (pdf) by the European Wind Energy Association

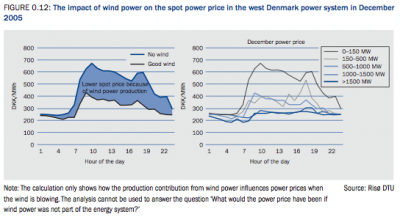

As the graph above suggests, the impact on price of significant wind injections is high throughout the day, and highest at times of high demand. When there’s a lot of wind, you end up with prices that get flattened at the price of base load, i.e. the marginal cost of nukes or coal, and wind no longer has any influence on price.

But the consequence of this is that the more wind you have into the system, the lower the price for electricity. With gas, it’s the opposite: the more gas you need, the higher the price will be (in the short term, because you need more expensive plants to be turned on; in the long run because you push the demand for gas up, and thus the price of gas, and thus of gas-burning plants, up).

In fact, if you get to a significant share of wind in a system that uses market prices, you get to a point where wind drives prices down to levels where wind power loses money all the time! (That may sound impossible, but it does happen because the difference between the low marginal cost and the higher long term cost is so big). There are two lessons here:

- wind power has a strongly positive effect for consumers, by driving prices down for them during the day.

- it is difficult for wind power generators to make money under market mechanisms unless wind penetration remains very low; this means that if wind is seen as a desirable, ways need to be found to ensure that the revenues that wind generators actually get for electricity are not driven by the market prices that they make possible.

That’s actually the point of feed-in tariffs, which provide stable, predictable revenue to wind producers, and ensure that their maximum production is injected into the system at all times, which influences market prices by making supply of more expensive producers unnecessary. And these tariffs make sense for consumers. The higher fixed price is added to the bill for the buyers of electricity, but as that bill is lower than it would have otherwise been, the actual cost is much lower than it appears. As I’ve noted in earlier diaries, studies in Germany, Denmark and Spain prove that the net cost of feed-in tariffs in these countries is actually negative, i.e. a apparent fixed cost imposed on consumers ends up reducing their bills!

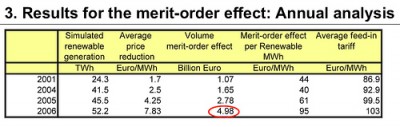

Assessment of the impact of renewable electricity generation on the German electricity sector (pdf) Mario Ragwitz, Frank Sensfuss, Fraunhofer Institute, presentation to EWEC 2008

The table above indicates that renewable energy (mostly wind, plus some solar) injections into the German electricity system caused, on average over the year, prices to be reduced by about 8 euros/MWh – about 15%. That translated into savings of 5 billion euros over the year for electricity buyers (utilities and other wholesale consumers), or 95 EUR/MWh of renewable energy injected. With a feed-in tariff of, on average, 103 EUR/MWh (which includes the high price for solar; wind tariffs are around 85EUR/MWh), the net cost of renewables is thus under 10 EUR/MWh, to be compared to a average wholesale price of 40-50 EUR/MWh. Thanks to the feed-in tariff, a wind MWH costs one fifth of a coal MWh!

In other words, by guaranteeing a high price to wind generators, you ensure that they are around to bring prices down. And that trick can only work with low marginal cost producers, thus not with any fuel-based generator, which would need to pay for its fuel in any case, and might end up requiring a higher price than the guaranteed level to break even, if fuel prices increased (as they would if such a scheme came up and encouraged investment in such plants).

So we get an glimpse of the fact that there is value in wind power for consumers which is not reflected directly through electricity prices, and is only remotely related to the actual cost of wind.

Value / externalities

Which brings us to our last point, the “value” of wind power, which has to include the other impacts of wind onto the system that are not captured by monetary mechanisms. This is also what economists call externalities, i.e. the impact of economic behavior or decisions which are not reflected in the costs or prices of the economic entity taking the decision. Pollution is a typical externality, but so is the impact on the grid of bringing in a new producer.

Regulation is meant to put a price on these items, in order to reflect the “true cost” of a given economic action, i.e. in this case a decision to invest in a wind farm or a gas-fired plant or otherwise. Amongst the externalities we need to discuss here are the intermittency of wind, carbon emissions (which, in this case, is an existing, improperly priced, externality of existing technologies which wind can help to avoid), and security of supply.

Intermittency and balancing costs

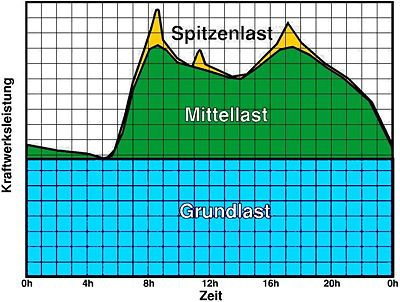

A traditional argument against wind (its availability is variable, and cannot be counted upon to fulfill demand), which people may be surprised to find listed here as an externality – but that’s what it is. In a market, you are not obliged to sell; the fact that the electricity grid requires demand to be provided at all times is a separate service, which is not the same thing as supplying electricity – it’s continuity of supply. But while wind is criticized for its intermittency, I never hear coal or nuclear blasted because the reserve requirements of the system need to be sized to be at least as big as the largest plant around, should that plant (which is inevitably a multi-GW coal or nuclear plant) happen to drop off. The market for MWh and the market for “spare MWh on short notice” are quite different animals, and the Germans actually treat them separately:

Source: Wikipedia

The Germans distinguish between permanent base load (i.e. the minimum consumption of any time, which effectively requires permanent generation, “Grundlast” in the graph above), semi-base load (or the predictable portion of the daily demand curve, “Mittellast” in the graph above), and peak/unpredictable demand (i.e. the short term variations of supply availability and demand – “Spitzenlast” in the graph above). Wind is now predictable with increasing accuracy with a few hours advance, and can, for the most part, be part of semi-base load; i.e., low winds can be treated just like a traditional plant being on maintenance: reduced, but expected, availability of a given asset.

(for contrasting views on this topic, you can read these two articles: Wind is reliable and Critique of wind integration into the grid on Claverton).

The reality here is that the service “reliability of supply” is well-understood, and the technical requirements (having stand-by capacity for the potentially required volumes) are well-known, there is plenty of experience on how to provide them (“spinning reserves”, i.e. gas-fired plants available to be fired up, or interruptible supply contracts with some industrial users who accept to be switched off at short notice) and experience and the relevant regulations have made it possible to put a price on that service.

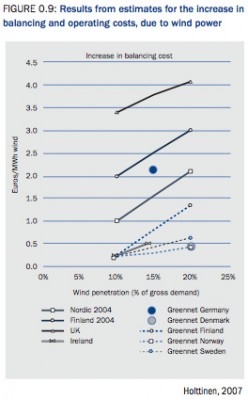

Source: Economics of wind (pdf) by the European Wind Energy Association

In the case of wind, the cost of the service (which a wind producer needs to pay to the grid operator in order to be able to provide its service, which is the same of kWh) is estimated at 2-4 EUR/MWh, i.e. 5% or less of the cost of wind. And, given that the relevant regulations exist, that externality can be easily internalised – and in that case, added to the cost of producing wind power – or deducted from the price wind generators can get for selling their “naked” MWh.

Carbon emissions

The second externality to mention is carbon emissions. In that case, it is not an externality caused by wind generation, it is an externality which is created by existing power generators, which is not properly accounted for yet today, but which wind generation avoids. In other words, there is a benefit for society to replace fossil fuel-burning generation by wind, but it is not priced in yet (or, in other words, the indirect cost of coal-burning is paid by the inhabitants of low-lying islands rather than by the consumers of that electricity).

Attempts to price carbon emissions are moving forward, with the European ETS (emissions trading system) and the expected “cap-and-trade” mechanism in the USA; these require carbon-spewing generators to pay for that privilege and materialize a new cost for them, which will be added to their cost of generating electricity (but not to that of wind, as it emits no carbon dioxide in the process).

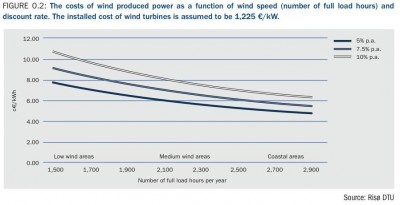

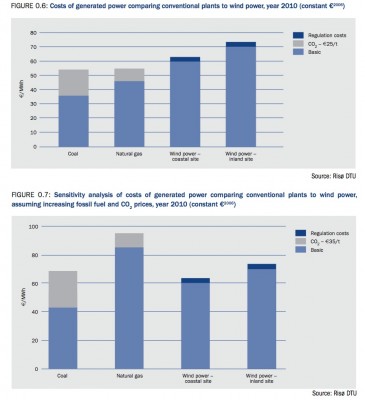

Source: Economics of wind (pdf) by the European Wind Energy Association

The grey area in the bars above is the added cost of producing electricity from coal or gas, for two different prices of carbon (note that the bottom graph also changes the cost of fuel, which increases the other component of cost for coal and gas). It has a significant impact on the net cost of production for these sources, and on the respective competitively of competing technologies. Note that the graph above includes the grid-related costs for wind discussed above, in dark blue.

It is no less legitimate to include the cost of carbon as it is to include the cost of stand-by capacity in the calculation of the cost of electricity. If we consider the power grid as a fully integrated system, then there is very little reason to include some externalities and not others – other, that is, than force of habit and lobbying by the incumbents who designed the rules around their exiting generation mix.

Security of supply

A power plant is an investment that can last 25 to 50 years (or even more, in the case of dams). Once built, it will create patterns of behavior that will similarly last for a very long time. A gas-fired plant will require supply of gas for 25 years or more (and the corresponding infrastructure, and attached services, employees … and lobbyists). Given worries about resource depletion (usually downplayed) and about the unreliability of some suppliers (hysterically exaggerated, c.f. the “New Cold War” hype about Putin’s Russia), it is not unreasonable to suggest that security of supply has a cost.

This may be reflected in long term supply arrangements with firm commitments by gas-producing countries to deliver agreed volumes of gas over many years – but, given all the Russia-angst we hear, this does not seem to be enough (most supplies from Russia are under long term contracts). Wind, which requires no fuel, and thus no imports, neatly avoids that problem, but how can that be valued in economic terms? That question has no satisfactory reply today, but it is clear that the value is more than nil.

Another aspect of this is that “security of supply” is usually understood to mean “at reasonable prices.” Fuel-fired power plants will need to buy gas or coal in 10, 15 or 20 years time and it is impossible today to hedge the corresponding price risk. Given prevalent pricing mechanisms, individual plants may not care so much (they will pass on fuel price increases to consumers), but consumers may not be so happy with the result. Again, here, wind, with its fixed price over many years, provides a very valuable alternative: a guarantee that its costs will not increase over time. Markets should theoretically be able to value this, but futures markets are not very liquid for durations beyond 5 years, and thus, in practice, they don’t do it. This is where governments can step in, to provide a value today to the long term option embedded in wind (i.e. a “call” at a low price). This is what feed-in tariffs do, fundamentally, by setting a fixed price for wind production which is high enough for producers to be happy with their investment today, and low enough to provide a hedge against cost increases elsewhere in the system (and indeed, last year, when oil and gas prices were very high, feed-in tariffs in several countries ended up being below the prevailing wholesale price: the subsidy went the other way round…).

Note that the regulatory framework will decide who gets access to that value: if wind is sold at a fixed price, it is the buyer of that power that will benefit from the then-cheap supply (and that may be a private buyer under a PPA, or the grid operator; depending on regulatory mechanics, that benefit may be kept by that entity, or have to be reflected into retail tariffs for end consumers). If wind producers get support in the form of tax credits or “green certificates”, it is wind producers that will capture the windfall of high power prices. So the question is not just how to make that value appear, but also how to share it. Both are political questions to which there are no obvious answers.

:: ::

So wind power has value as a low-emissions, home-grown, fixed cost supplier. It also tends to create significant numbers of largely non-offshoreable jobs, which may be an argument in today’s context. It also has, in a market pricing mechanism, the effect of lowering prices for consumers thanks to its zero-marginal cost. Its drawbacks, i.e. mainly intermittency, can be priced and taken into account by the system. (Birds/bat are not a serious issue, despite the hype; esthetics are a very subjective issue which can usually be sidestepped by avoiding certain locations – the US is big enough, and Europe has the North Sea)

Altogether, wind seems to be an excellent deal for consumers – and an obvious pain (in terms of both lower volumes, and lower prices) for competing sources of power, except maybe those specialising in on-demand capacity.

In other words: sticking with mostly coal or nuclear is a political choice, not an economic one.

This article is re-published (by Dirk-Jan de Wilde) from the The Oil Drum with permissions of the author Jérôme Guillet.

2 replies on “The cost of wind, the price of wind, the value of wind”

this website is not nice ! It is VERY NICE . information on site is very nice. I am fan of it

I want to know the most suitable Wind energy option available for the North-eastern region of India which is Biological hot-spot for the WHOLE-WORLD,where the rare flora and fauna should not be disturbed by mindless persuit of conventional large fossil fuel-based MEGA POWER plants.

Can a MANDATORY world-opinion be created by all the enlightened THINK-TANKs of the WORLD;in the interestof our PoSTERITY,which becomes inviolable by the CONSTTUTIONALISTs MYOPIC Planners.