The five key Game Changers that are shaping the Energy Transition

Posted by Rembrandt Koppelaar in Books, Economics, Transport No Comments» The big shift from fossil fuels to renewable energy is so global and multi-faceted that unless you are an energy news junky it is difficult to keep track. An update on the latest developments is sorely needed and thus our book: The Tesla Revolution: Why Big Oil is Losing the Energy War, was borne, written by us, Rembrandt Koppelaar and Willem Middelkoop.

The big shift from fossil fuels to renewable energy is so global and multi-faceted that unless you are an energy news junky it is difficult to keep track. An update on the latest developments is sorely needed and thus our book: The Tesla Revolution: Why Big Oil is Losing the Energy War, was borne, written by us, Rembrandt Koppelaar and Willem Middelkoop.

The book’s six chapters give an overview of the entire spectrum of change: electric cars, fuels, batteries, renewables, climate change, power grids, (geo)politics, and lots more. To give a taster we share five of the key game changers of the Energy Revolution, starting with the impact of Tesla, the first solar, battery, and electric car company in the western hemisphere.

1. Tesla has put electricity on the map as the future of mobility

In 2008 Tesla Motors was only a small Silicon Valley start-up with a very expensive electric sports car, the Roadster, a novelty item for the wealthy among us. Today the company is a world leader with over 200,000 of its battery electric vehicles (EV) on the road just a few months before its game changing Model 3 is ready for shipping to customers: a sleek five seater Sedan with a 350 kilometres single charge range and a $35,000 sales price. When the model 3 was unveiled a year ago it led to the biggest pre-order in the history of (electric) cars at over 325,000 sold totalling $1400 million in a single week. Today Tesla’s stock value is even bigger than 100 year old Ford or General Motors.

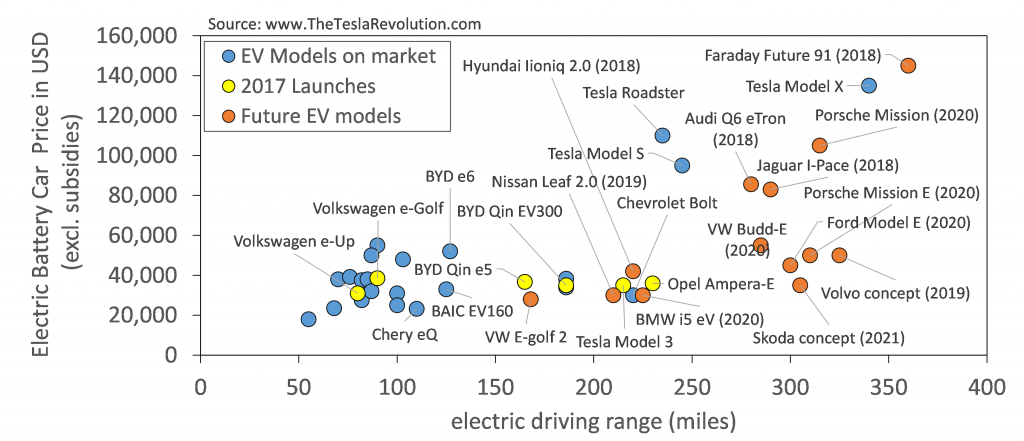

The innovative capacity and success of Tesla has led to a total shift in the car industry: electric is now the future of mobility. All large car companies are putting billions of dollars into launching several plug-in and battery vehicles as soon as possible. At the front of the curve are Tesla’s Model 3 and GM’s Chevrolet Bolt, both with a 300+ kilometre range priced below $40,000.

Car companies in the race to deliver a similar car before 2020 include Renault, Nissan, Volkswagen (Audi, Porsche and Skoda brands), Ford, Fiat, Hyundai (Kia), Honda, Toyota, and Daimler (Mercedez Benz). Not to forget are the Chinese ‘Tesla’ Build Your Dreams (BYD) and car giants BIAC and Geely (owner of Volvo), which along smaller Chinese competitors sell dozens of battery EV models in China. Globally about 50 EV models are available on the market (of which about half only in China), and this will increase by a factor 3 in a few years’ time.

2. The costs of batteries dropped by a factor 6 in ten years

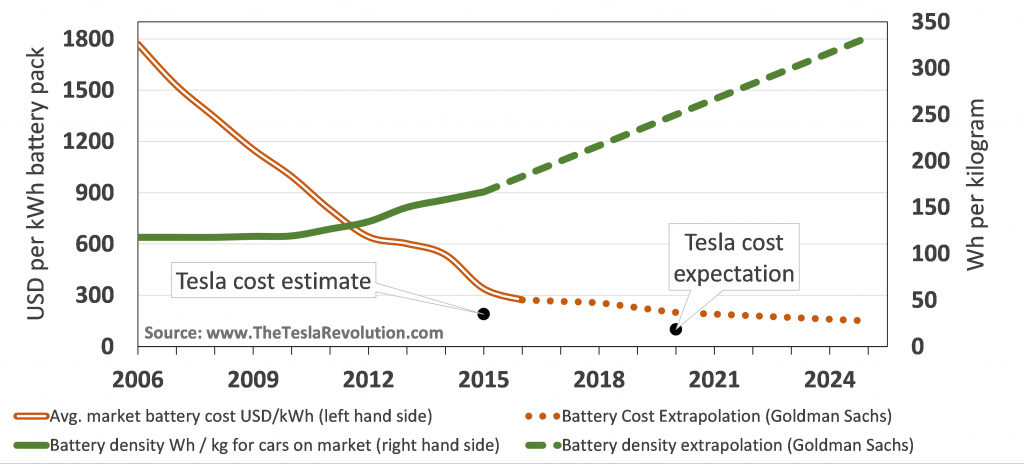

The key driver of the electric car revolution are innovations in lithium-ion batteries that have led to rapid cost declines and enormous performance improvement. The price of a battery pack has dropped by a factor 6 since 2006, from $1800 to $300 in 2016. At the same time the energy that can be packed in a kilogram of battery doubled, from 100 to 200 Watt-hours, which means double the driving range for far less money.

Electric cars are increasingly affordable, and industry analyst expects that soon after 2020 their cost at purchase will be equal to diesel and gasoline cars, not counting the far cheaper cost of using electricity over fuels. The luxurious Tesla Roadster was launched with a price tag of $109,000, of which battery costs alone were over $50,000. In 2016 the same battery pack costs less than $10,000, and consequent new battery designs will in the 2025-2030 time frame result in $5,000 for a Tesla Model 3 type battery pack with far greater performance.

3. A peak in the demand for oil is in the cards within fifteen years

The oil industry is looking at the future demand for oil with increasing uncertainty. Shell’s CEO Ben van Beurden has sent out a warning that oil use could start to fall permanently in the 2020s. BP does not see a peak yet, but acknowledges that electric cars will slow down oil demand from 2025 onwards. And even the oil producing OPEC countries are accepting the possibility of a peak in oil demand as soon as 2026 in one of their 2016 outlook scenarios.

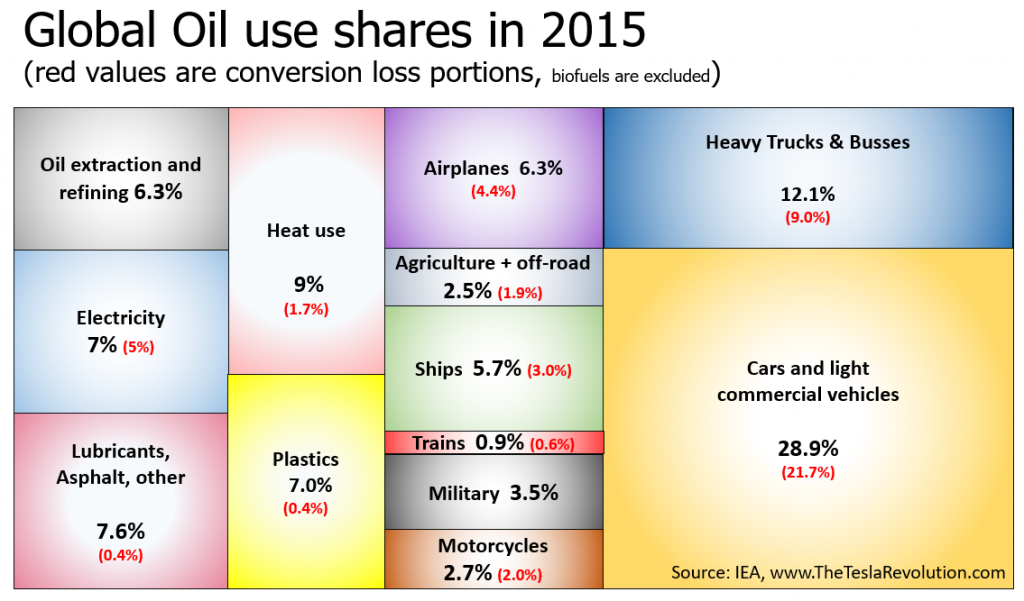

The key driver is an acceleration in electric car sales. In 2017 already over a million will be sold and according to the International Energy Agency (IEA) this could grow to 40 million by 2030. In comparison over 70 million diesel and gasoline cars are sold every year at present (+ 25 million commercial vehicles), half of which replaces older cars that are crushed, and half resulting in additional cars on the road. The scenarios from the IEA (and others like Bloomberg new energy foundation) imply that oil based cars within fifteen years will become a shrinking market. Since road transport contributes nearly 50% to oil demand growth, this is a complete game-changer.

Not yet on the radar of most, but equally as important, are busses, vans and urban trucks. World leader China already replaced a third of its busses by battery electric ones, and dozens of cities like London, Los Angeles, Chicago, Amsterdam, Madrid, and Stockholm, are following in its footsteps. The Chinese ‘Tesla’ BYD is already selling short distance purpose electric trucks in the USA and China, Mercedez Benz will launch an urban electric truck, and several newcomers have joined including Tevva Motors, Workhorse, OrangeEV, Wrightspeed, and Terberg. Companies with big commercial fleets are also embracing electric, like FedEx which has 1200 e-Vans in operation built by Navistar, Via-Motors, and Nissan. Deutsche Post even decided to produce its own electric vans, now ramping up to 10,000 a year, much to the chagrin of Volkswagen.

And there is more. Several companies including Volvo, Atlas Copco, MacLean, and SandVik, are working on battery electric bulldozers, excavators, and haulage trucks for construction, mining, and other off-road purposes. The first fully electric gold mine will start operating in 2018 in Canada. Shipping is also being transformed. After Norled showed successful operations of the first Lithium battery electric car ferry in Norway, its competitor Fjord1 ordered five more built in Turkey and Norway, and companies in Finland, Sweden, and Denmark are following in Norway’s footsteps. Hybrid electric boats for longer distances are also increasing with 20+ vessels in operation, and dozens more being built such as California’s 600 passenger Enhydra.

Even oil demand for plastics may slow down since chemical giants like DOW and DuPont and food producers like Nestle and Unilever are looking into increasing plastics recycling from 10% at present to 70% similar to the paper industry. A target that is possible thanks to innovations in optical and robotic sorting, density separation, and chemical recovery of plastics.

4. Globally coal usage is declining

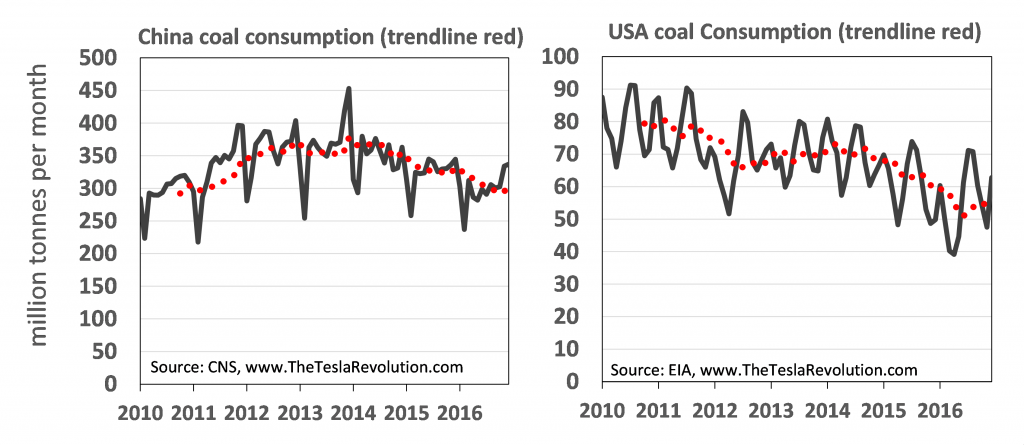

Until recently China was the motor of coal growth in the world. Extraction grew between 2000 and 2013 as never seen anywhere before, from 30% to 48% of all coal mined globally. In other words China gobbles up half of all coal used worldwide. It came as a big surprise that the Chinese government managed to ‘tame’ the coal sector by capping coal mining and power plant expansion. Since 2013 China’s coal use has declined by 18% from 4.4 to 3.6 billion tonnes.

The impact is so big that global coal use dropped in both 2015 and 2016. The IEA is expecting flat coal demand in the next five years. A further decline is equally plausible since coal power plant expansion in India is slowing down substantially and the country may not need more coal to meet electricity demand growth after 2024. Recently India overtook the US as the 2nd biggest coal user in the world as coal use in the biggest economy of the world has declined by 30% since 2010, largely due to a shift to natural gas and wind power. A trend the renowned rating agency Moody’s expects to continue since constructing wind mills in the US – including a $0.02 per kWh wind tax credit that will remain in place until 2020 – is now cheaper than operating existing coal power plants.

Several large coal consuming countries are following the trend. South-Africa’s energy giant Eskom has announced the closure of 20% of the countries coal power plant capacity. And South Korea’s favoured new presidential candidate Moon Jae-In has announced that he will shut-down the countries coal power plants. The list of countries with substantial coal expansion plans is getting increasingly smaller and still includes Bangladesh, Vietnam, Turkey, Indonesia, Pakistan, the Philippines, Japan, and Poland.

5. Solar and Wind are commercial sources of electricity

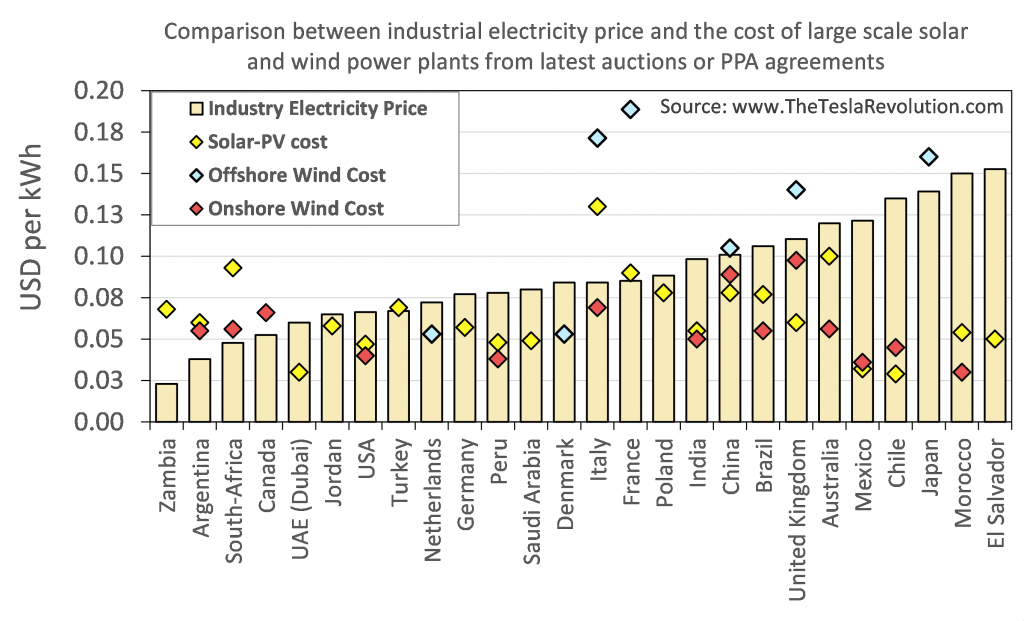

Recent record low prices for large scale solar surprised even the strongest sceptics in the world. In November 2014, a 100 MW solar project was tendered in Dubai at a price of $0.06 per kWh, far cheaper than the countries natural gas generation price of $0.09. The record was shattered in 2016 when a price of $0.03 per kWh was contracted in the emirate for then the world’s largest 800 MW solar plant. Similar low – unsubsidised but sales and price guaranteed – solar power prices have been agreed in tenders in sunny regions of Mexico, United States, and Chile. Even in Germany, with its cloudy skies in January 2017 tender for solar ended with a price of $0.066 per kWh, a cent below the $0.075 per kWh price the German industry pays for its electricity (excluding taxes).

Similar cost breakthroughs are unfolding in onshore wind. The US holds the record for the absolute bottom with wind costing $0.02 per kWh ($0.04 without tax credits) under a Purchasing Power Agreement (PPA) with a 20 year sales guarantee. Morocco’s unsubsidized tender yielded a result of $0.03 per kWh and a range from $0.03 to $0.06 per kWh has been achieved in a dozen countries including Mexico, Chile, India, and Peru. Even offshore wind is dropping much faster than anticipated, with record Danish and Dutch tender results in 2016 at $0.055 for close to shore projects (excluding onshore grid connection costs).

The cost declines have made solar and wind commercial sources of power. In 15 out of 26 countries that we compared (see figure below) large scale solar and wind electricity costs are several cents per kWh lower than what industrial users pay for their electricity, which typically ranges between $0.06 and $0.12 per kWh (including grid connection costs). Not surprisingly, total investments in solar and wind in 2016 at 287 billion USD were over twice the money invested in fossil fuel power plants.

Several developments show that solar and wind at these prices are commercial at 10 MW+ scale for a wide range of sectors and companies:

- Big utility companies that previously focused on fossil fuels, like E.On and RWE, Vattenfall, and Engie (formerly GDF-Suez) have shifted their investments to mostly renewables completed with natural gas.

- Corporations are increasingly sourcing their electricity from solar and wind power under Purchasing Power Agreements (PPA). In 2016 in the US, Europe and Asia together 5 GigaWatt capacity was contracted by corporations under PPA agreements according to Bloomberg New Energy Finance. Several hundred corporates are involved and some of the largest deals were made by Microsoft, Mars, Dow Chemical, Ikea and Amazon.

- As a world’s first the Steel industry in Mexico signed a PPA to purchase electricity from a solar plant for 20 years. In the EU and the US steel producers stay in business thanks to favourable electricity price contracts of $0.03-0.05 per kWh plus Chinese steel import tariffs.

- Globally 30 mines now have on-site wind or solar installed in complement to grid or diesel generation with a total capacity of 1 GigaWatt. The 3rd largest copper mine in the world, Collahuasi in Chile, has initiated a tender to attract 150 MW of solar power in addition to 25 MW of solar it already has installed. Once completed in 2020 the solar park will be able to supply 40% of the copper mine’s electricity use.

The great news is also that cost declines will continue. Thanks to efficiency gains we now need 2 solar panels instead of 3 to get the same amount of electricity as ten years ago. Today’s panels on average can capture 17% of the solar rays, the best already reach 20%, and within ten years we 25% efficiency is within reach. The same holds for offshore wind where the average turbine size now is 5 MW but already 8 MW size turbines are starting to be installed, and 10 MW giants are on the horizon. Bigger turbines means more wind generation and less costs.

Afterword

The speed of development in electric cars, batteries, solar and wind almost makes it look like the energy transition will soon be completed. Whilst major breakthroughs are here change does not however happen magically. Major efforts are still needed in battery research, managing grids with lots of solar and wind, technology commercialisation like floating wind, shifting away from coal as a heating source, eventually going beyond natural gas as a ‘transition fuel’, and replacing scarce materials like cobalt in batteries. Like we discuss in the first chapter of The Tesla Revolution, it will likely take until the end of this century before the energy transition is fully complete, and there still is a long way to go.

If after reading you’re hungry for more in addition to reading the book.

Direct link to order.